does binance send tax forms

BinanceUS shall not be liable for any consequences thereof. While Binance US might not be sending out 1099-K forms the IRS is taking a hard stance on crypto tax evasion.

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

The best way to remain tax compliant with the IRS is to report your crypto taxes accurately.

. BinanceUS does NOT provide investment legal or tax advice in any manner or form. Please utilize your transaction history to fulfil any local tax filing. BinanceUS is making it easier for users to complete their tax returns by upgrading our tax reporting tool.

The IRS will receive a duplicate copy of your Form 1099-K. These transactions will be imported as Receive and you will need to change the transaction type to Send after uploading the file. There are a few ways you can import your transactions to Coinpanda.

Prepare your tax forms for Binance US. Three of the main jurisdictions where this happens are the United Kingdom the United States and Canada. If you receive a Form 1099-B and do not report it the same principles apply.

Also you can try integrating a crypto tax filing service with your Binanceus account. It is a one stop shop for cryptocurrency trading buying and. NO Binance does not report to the IRS.

Log in Get Started We dont accept any new clients for 2021 tax season see you next year. Does Binance report to tax authorities. If you need to file taxes for your cryptocurrency investments you can generate a statement of your Binance account to perform tax calculations.

Answer 1 of 5. Simply follow the steps below to get your API keys key secret and your tax forms will be. Binance is the largest cryptocurrency exchange founded in 2017 by Changpeng Zhao.

Imagine if Binance establishes partnership with us and has this capability in-built to send out tax forms directly to your email - that would be a great step towards compliance and could avoid. Binance US pairs with Koinly through API or CSV file import to make reporting your crypto taxes easy. Please consult an outside tax professional for guidance on your personal tax obligations.

It performs over 1400000 transactions per second. That is such crap. By law the exchange needs to keep extensive records of every transaction that takes place on the platform.

If you earned at least 600 through staking or Learn and Earn rewards BinanceUS issues 1099-MISC s and reports to the IRS. Binance does not do much of the hard work for you when it comes to calculating your. Missing transactions must be imported manually since Binance does not allow exporting the completely history as XLSXCSV.

Please visit this page to learn more about it. The ownership of any investment decisions exclusively vests with you after analyzing all possible risk factors and by exercising your own independent discretion. Does binance report to tax.

This is the simplest way to synchronize all your trades and transactions automatically. Therefore if you receive any tax form from an exchange the IRS already has a copy of it and you should definitely report it to avoid tax notices and penalties. Binance a Malta-based company is one of the most popular crypto exchanges in the world.

Binance does not do much of the hard work for you when it comes to calculating your crypto. Import trades automatically and download all tax forms documents for Binance easily. Binance is not a US-based exchange and it does not report anything to the IRS.

Now i need to issue an amended tax return and i just dont want to deal with this crap. Binance does not do much of the hard work for you when it comes to calculating your crypto taxes. We have integrated Binance via API on BearTax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes.

December 10 2021 - 2 min read. Binance does not issue a 1099 form to its customers because it is not a US-based exchange and it no longer serves US. Does binance provide tax forms.

If anyone wants register with binanceus you can register with my referral then here it is. 1099 form on your own or send them to your tax account assistant. According to their website they stopped issuing 1099-K s from 2021 so they dont report to the IRS.

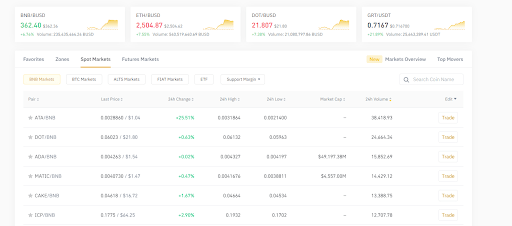

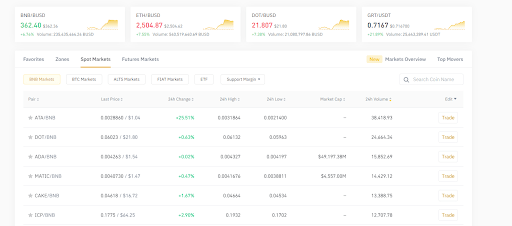

Likewise Coinbase Kraken Binanceus Gemini Uphold and other US exchanges do report to the IRS. Once connected Koinly becomes the ultimate Binance US tax tool. The good news is while Binance US might not provide tax forms and documents Binance US does offer 2 easy ways to export transaction and trade history.

Yes BinanceUS sends Forms 1099-MISC to traders who have earned more than 600 on the platform from staking and rewards. If you expected to receive a Form 1099-K but didnt you probably only met one of the qualifications listed above not both. Yes Binance does provide tax info but you need to understand what this entails.

If your account meets both of the above criteria BinanceUS will send you a Form 1099-K in January 2021 to your accounts address of record. In this article well show you how you can prepare for the tax season and export your transaction history. Answer 1 of 12.

Although it previously issued certain traders Forms 1099-K BinanceUS discontinued the practice. Log in to your Binance account and click Wallet - Transaction History. They can request your data from any larger crypto exchange operating in the US.

Binance gives you the option to export up to three months of trade. We have integrated binance via api on beartax with which one can consolidate trades review depositsreferrals calculate capital gains and download tax forms within few minutes. Filing cryptocurrency taxes can be complicated especially for those who are new to crypto.

Which Tax Documents Does Binance Give You. Connect your account directly using API keys. Please consult an outside tax.

Why doesnt binance us send a 1099. Binance does not allow exporting your conversions so this must be added manually. Based exchanges such as Coinbase and Gemini will fill out IRS forms for you Binance only gives a list of all your trade history.

Import your Binance US trades automatically generate your tax forms and file your taxes. They have their headquarters in Malta. These kinds of incomes are classified as ordinary income.

100 Legit Track Mtcn Before Payment Contcat Us For Your Own Mtcn Today Get Western Western Union Money Transfer Western Union Money Market Account

Right Here S Why Bears Hope To Pin Bitcoin Below 60k Forward Of Friday S 1 1b Choices Expir

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

3 Lessons Web 3 0 Can T Afford To Ignore Sponsored Bitcoin News Bestcryptotrends Com In 2022 Technological Change Blue Artwork Private Server

Usa Social Security Card Psd Template Ssn Psd Template Card Templates Free Social Security Card Psd Templates

How To Do Your Binance Us Taxes Koinly

Binance Menambahkan Metode Transfer Bank Untuk Pengguna Indonesia Yang Didukung Oleh Tokocrypto Blog Binance

3 Steps To Calculate Binance Taxes 2022 Updated

Connect Crytpo Portfolio To Coinmarketcap Api Connection Portfolio Api Key

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Binance Tax Reporting How To Do It Ultimate Guide By Cryptogeek

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

How To Obtain Tax Reporting On Binance Frequently Asked Questions Binance Support

Binance Us Launches Tax Statements Portal And Joins Taxbit Network Taxbit Blog

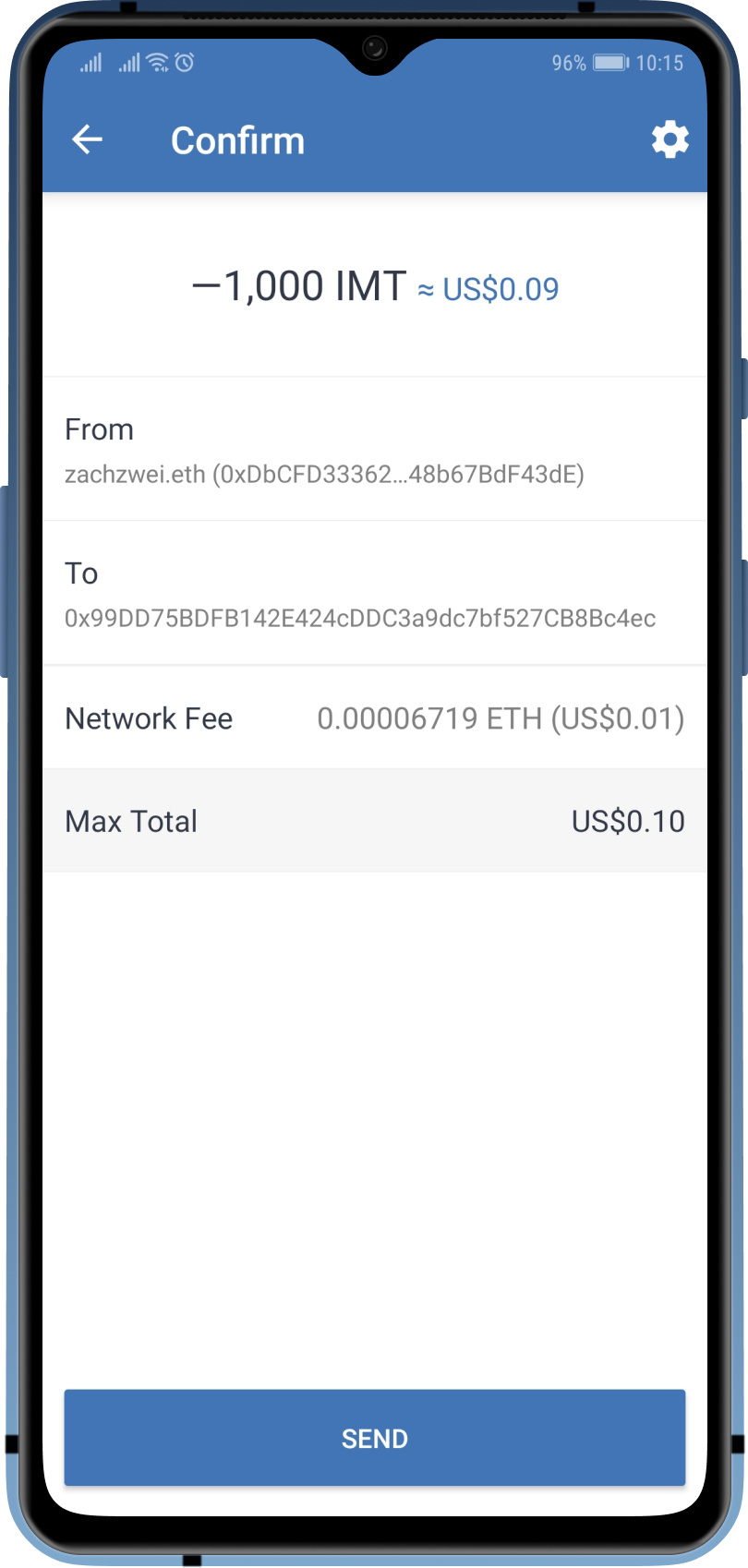

Sending Cryptocurrencies Faqs Trust Wallet

Free Coin Mining Png Svg Icon Social Media Icons Free Icon Finance Icons